FAQ's

e.Deposit requires a smartphone with a camera and is accessed through our M1.Mobile app. To make a deposit, select “Deposit” from the menu, key in the amount of the deposit, endorse the check with your name and “For M1 Mobile Deposit”, and take a photo of the front and back of the check. That’s it! Within seconds of submitting the transaction, you’ll receive a confirmation.

Deposits will not be immediately available after a mobile deposit. Depending on time of day, and day of the week, the check may be available the same business day. You will not see your deposit on the weekends or holidays; these will be credited the following business day.

- Deposit Cut-off Time for immediate deposit: 2:30 pm

- Any check deposited after 2:30 pm will be credited the following business day.

- The deposit will show up as an ACH deposit.

Michigan One Community Credit Union reserves the right to reject all items that are irregular or not as specified in the full Agreement.We reserve the right to place a hold on any check that is deposited per our standard Hold Guidelines. You will be contacted within 1 business day if a hold is placed on your account for any check deposited through the mobile app.

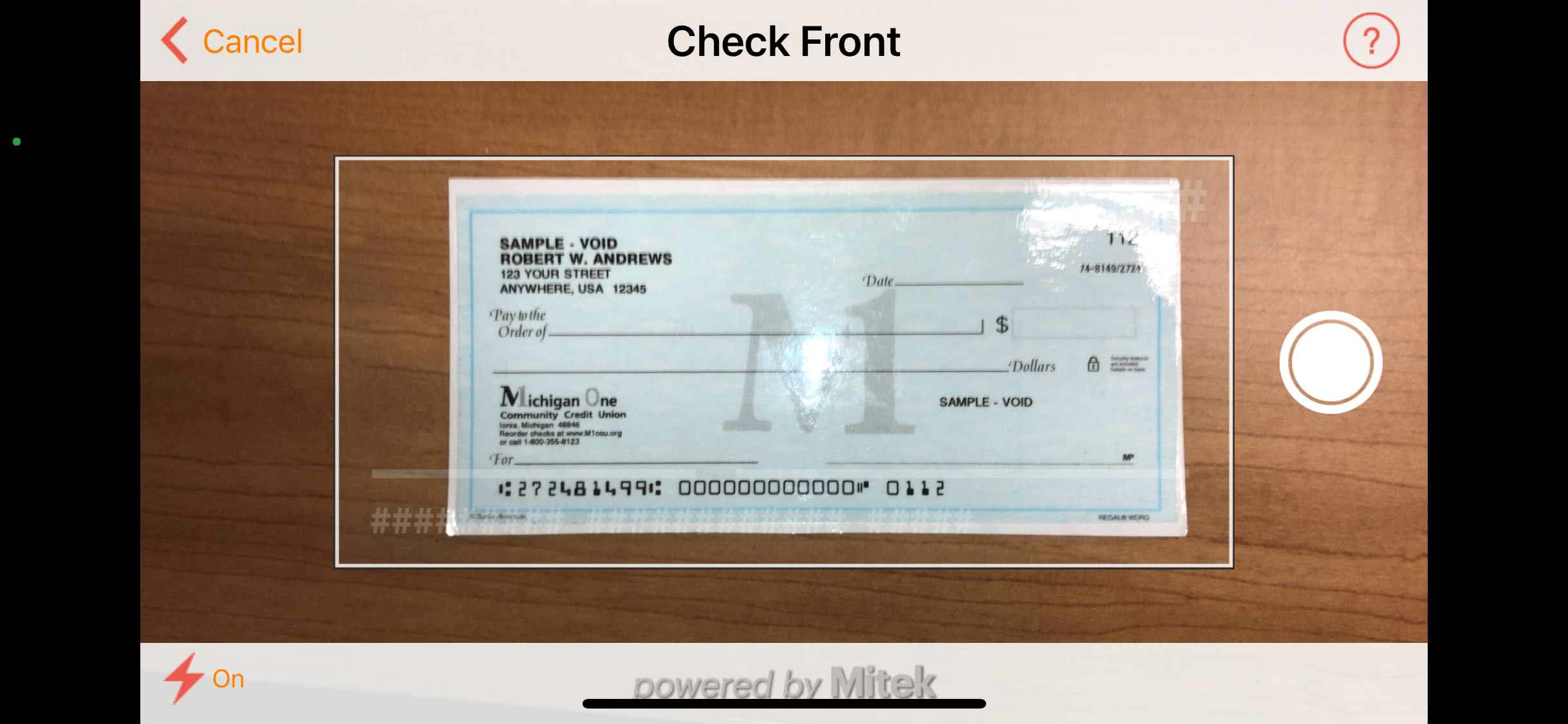

- Endorse your check

- On the back of your check, sign the check and write “For M1 mobile deposit"

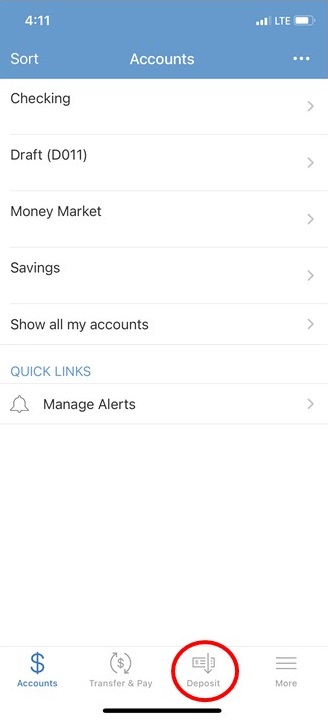

- Log into M1.Mobile and select Deposit

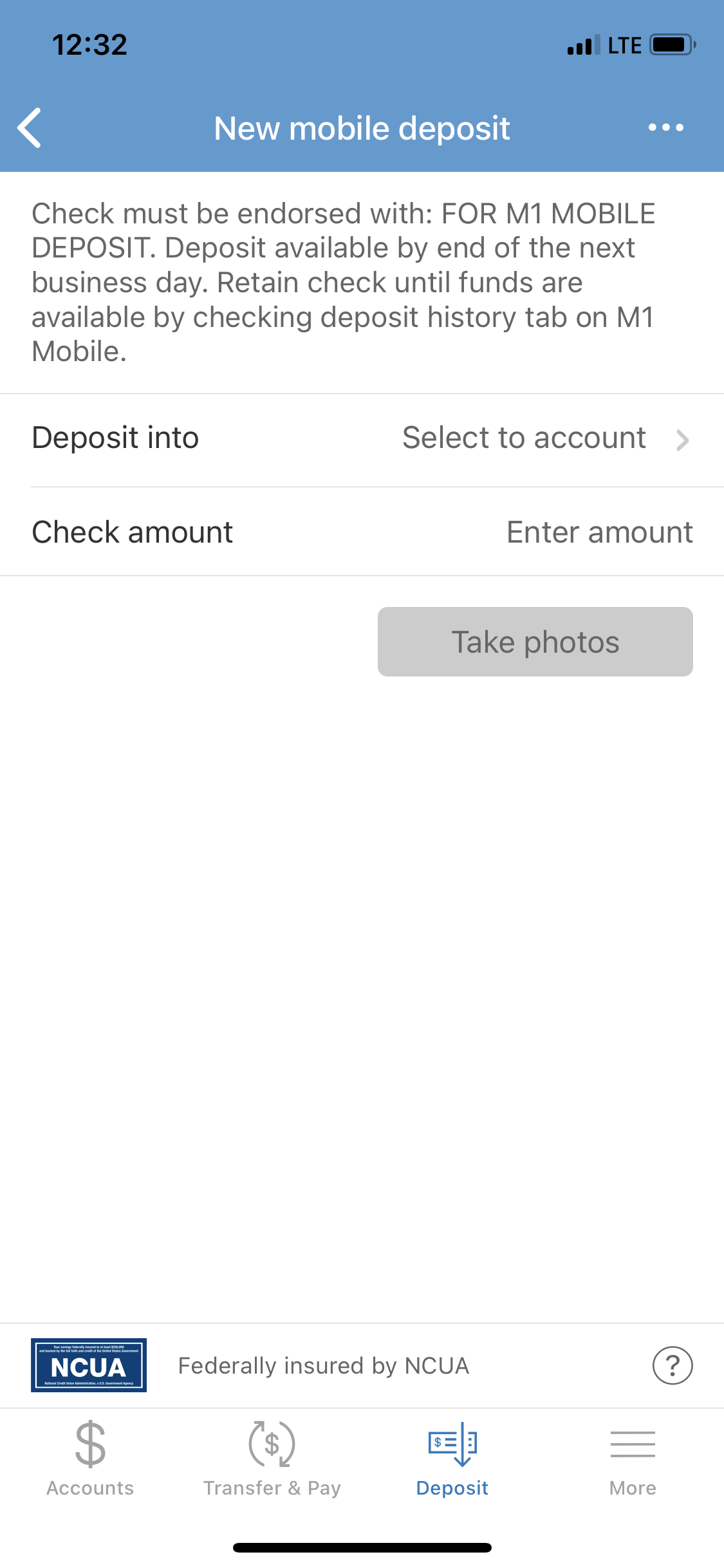

- Select the account you want the check deposited into

- Input the amount of the check

- SNAP!

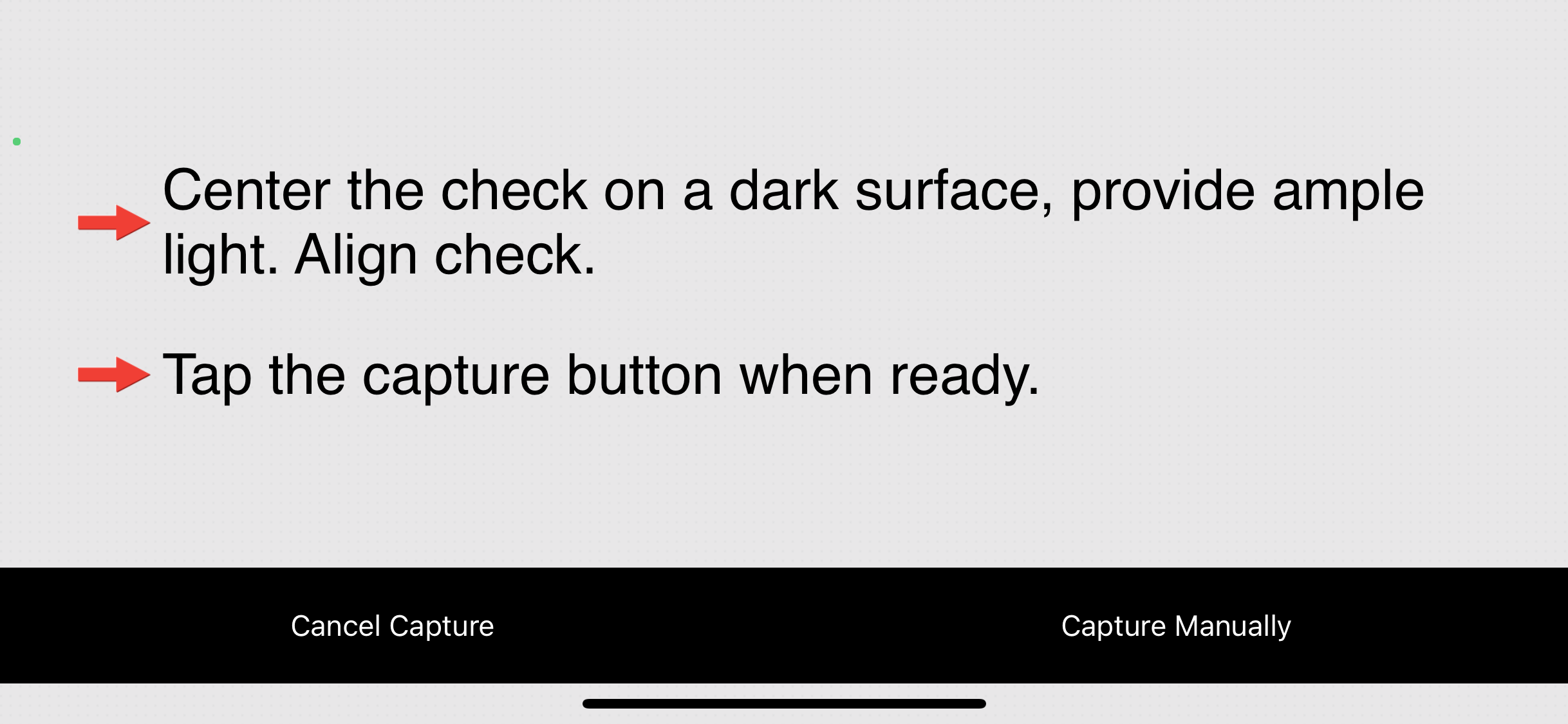

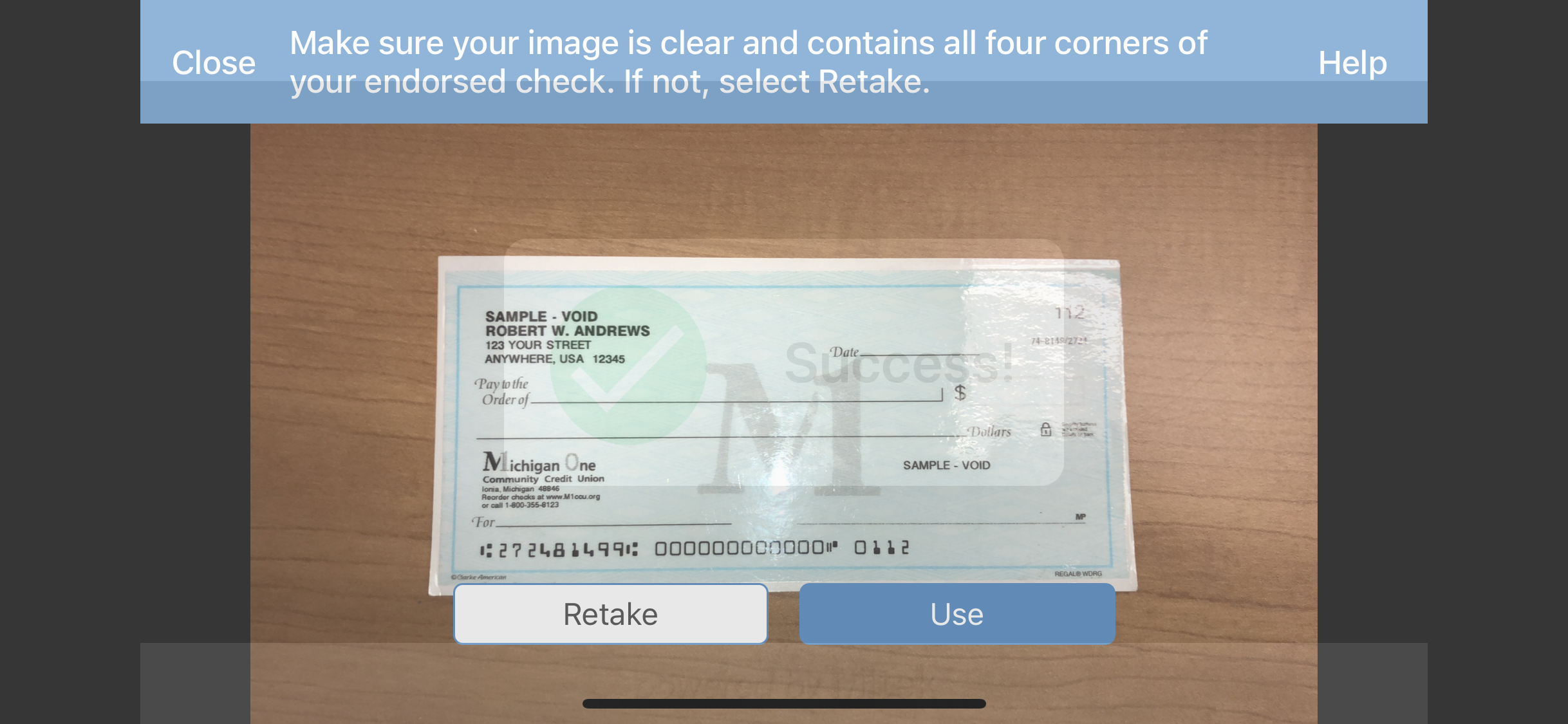

- Take a photo of the front of your check (all edges must be visible).

- Take a photo of the back of your endorsed check (all edges must be visible).

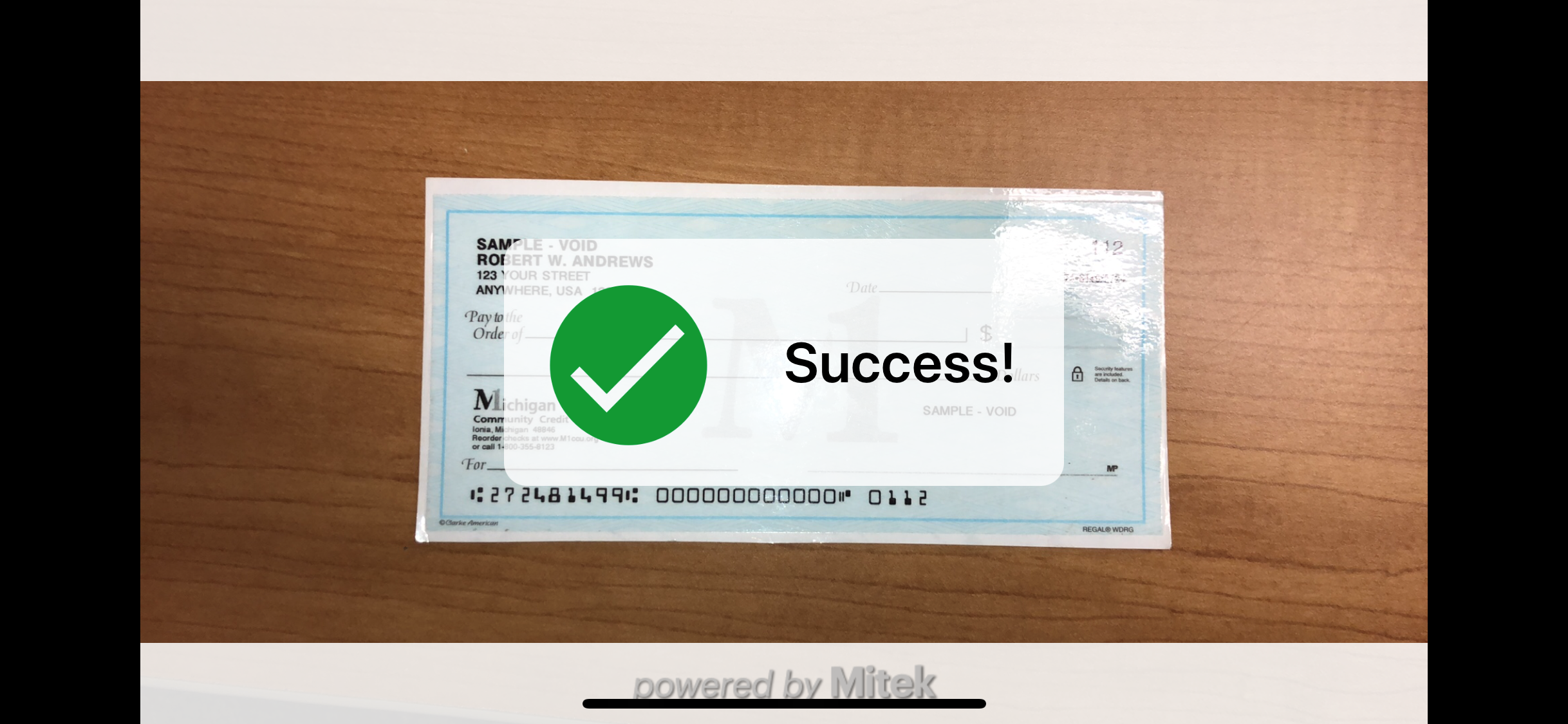

- Review the information on your screen. If all is correct, click "Deposit check".

- You will receive confirmation that the deposit was submitted.

- Temporarily store the original check until you have confirmed that the transaction has successfully been deposited

Personal and business U.S. checks can be processed through M1.Mobile e.Deposit. Checks from Canada and other foreign countries, savings bonds and poor image quality checks must be deposited at the credit union.

e.Deposit is very secure. It features multiple layers of security, giving your account and check data the highest level of safety available.

You can transmit mobile deposits to the credit union 24-hours a day, 7-days a week including weekends and holidays, with the exception of our routine maintenance downtime.

Accepted deposits will be available by the end of the business day if submitted before 2:30 p.m. Any check submitted after 2:30 p.m. will be credited to your account the next business day.

Make a note on the check that it was deposited via mobile. Keep the check until the funds are credited to your account (this could take a couple of days), then shred the check. An image of the deposited check remains available on your phone for 45 days.

The software has built-in duplicate detection tools that usually detect items already deposited. If the software detects potential duplicate checks, an alert prompts you to make a decision about the items in question.

The software has an Image Quality Assessment (IQA) tool that automatically identifies problems with the check image. If a problem is detected, you’ll be asked to retake the photo.

- It’s convenient. Save time and money by eliminating special trips to the credit union.

- It’s easy. Enter the amount of the check deposit. Take a photo of the front and back. Review and submit.

- It’s secure. M1.Mobile uses several layers of security to protect your account and check data.

- It’s open 24/7. Day or night, you can check balances, transfer funds and make deposits.